Yaw Opoku Mensah, a member of the New Patriotic Party (NPP) Communications Team, has issued a scathing critique of the government’s decision to reduce cocoa producer prices.

Warning farmers against relying on the current administration to protect their livelihoods, Mensah argued that the hardships facing the sector are born of domestic mismanagement rather than global economic shifts.

Disputing the “Crisis” Narrative:

Citing the International Monetary Fund’s (IMF) fifth review of the Extended Credit Facility (ECF) program, Opoku Mensah asserted that the data contradicts any claims of a sector-wide emergency.

“The IMF’s 5th ECF review makes one thing crystal clear: there is no production crisis and no financial crisis in Ghana’s cocoa sector,” Mensah stated.

He added that, “Prospects are positive, output is rising, and cash flow remains balanced while international prices remain high.”

He maintained that when the industry’s fundamentals are robust yet farmers continue to struggle, the blame lies squarely with “sheer incompetence in management.”

He specifically pointed to neighboring Côte d’Ivoire, where farmers are reportedly receiving the equivalent of approximately GH¢3,690 per bag, questioning why Ghanaian farmers have been excluded from this global windfall.

A Surge in Revenue:

The outcry comes amidst a period of record-breaking export earnings for Ghana.

According to Bank of Ghana data, cocoa export revenues for the first four months of 2025 reached $1.84 billion.

This represents a staggering increase from the $579 million recorded during the same period in 2024—surpassing the total earnings of the first eleven months of the previous year.

Projected Production Growth (2024/2025):

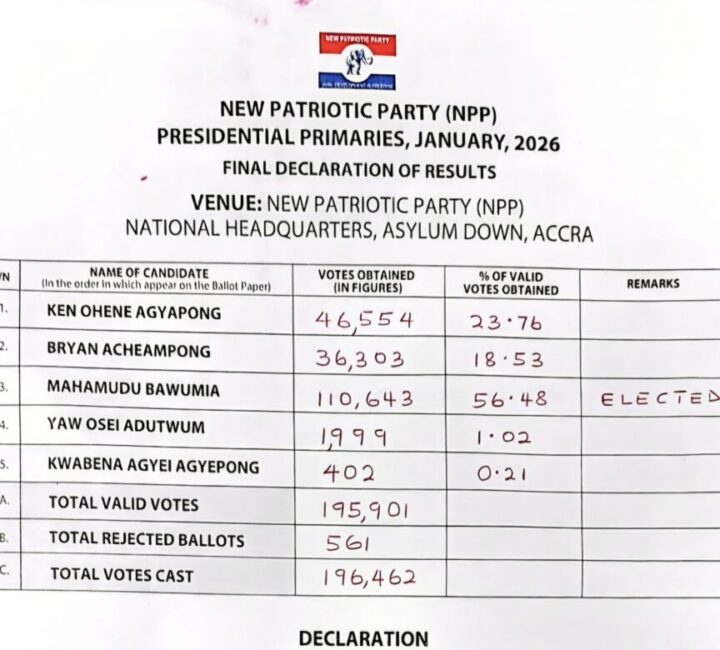

| Metric | 2023/2024 Season | 2024/2025 Projection | % Increase |

|---|---|---|---|

| Production (Metric Tonnes) | 531,000 | 700,000 | 32% |

Analysts credit this revenue surge to a combination of higher farmgate prices, a crackdown on illegal mining (galamsey), and reduced smuggling.

Market Mechanics vs. Leadership:

While the revenue figures are high, the discrepancy in farmer pay is often attributed to Ghana’s reliance on the futures market.

In this system, prices are locked in months in advance based on previous averages.

While this provides a safety net against price drops, it prevented Ghana from fully capitalizing on the price spikes of 2024.

However, for the 2025 season, these high 2024 prices should—in theory—be reflected in current contracts. Opoku Mensah remains unconvinced by technical justifications.

“You cannot hide behind international prices when those same prices are benefiting farmers everywhere else,” he concluded.

He added, “When the fundamentals are strong and farmers are still struggling, the issue is not the market—it is leadership.”

Story By Michael Ofosu-Afriyie,

Kumasi.